-

@ Jax

2024-11-30 22:33:26

@ Jax

2024-11-30 22:33:26 Introduction

The banking industry is undergoing a significant transformation, driven by the rise of fintech. Financial technology, or fintech, refers to the use of technology to improve and automate financial services. From mobile banking apps to digital payment systems, fintech is revolutionizing the way we manage our finances.

Introduction

The banking industry is undergoing a significant transformation, driven by the rise of fintech. Financial technology, or fintech, refers to the use of technology to improve and automate financial services. From mobile banking apps to digital payment systems, fintech is revolutionizing the way we manage our finances. The Rise of Mobile Banking

Mobile banking is one of the most significant trends in fintech. With the rise of smartphones, people can now access their bank accounts, make payments, and transfer money on the go. Mobile banking apps have made banking more convenient, accessible, and user-friendly.

The Rise of Mobile Banking

Mobile banking is one of the most significant trends in fintech. With the rise of smartphones, people can now access their bank accounts, make payments, and transfer money on the go. Mobile banking apps have made banking more convenient, accessible, and user-friendly. Digital Payments

Digital payment systems, such as Apple Pay, Google Pay, and PayPal, are becoming increasingly popular. These systems allow users to make payments online and offline using their smartphones. Digital payments are fast, secure, and convenient, making them an attractive alternative to traditional payment methods.

Digital Payments

Digital payment systems, such as Apple Pay, Google Pay, and PayPal, are becoming increasingly popular. These systems allow users to make payments online and offline using their smartphones. Digital payments are fast, secure, and convenient, making them an attractive alternative to traditional payment methods.Cryptocurrencies and Blockchain Cryptocurrencies, such as Bitcoin and Ethereum, are digital currencies that use cryptography for secure financial transactions. Blockchain technology, which underlies cryptocurrencies, is a decentralized, digital ledger that records transactions across a network of computers. Cryptocurrencies and blockchain technology have the potential to disrupt traditional banking systems and create new opportunities for financial innovation.

Robo-Advisors and Artificial Intelligence

Robo-advisors are digital platforms that use artificial intelligence (AI) to provide automated investment advice. Robo-advisors have made investment advice more accessible and affordable, especially for younger investors. AI is also being used in other areas of banking, such as risk management and customer service.

Robo-Advisors and Artificial Intelligence

Robo-advisors are digital platforms that use artificial intelligence (AI) to provide automated investment advice. Robo-advisors have made investment advice more accessible and affordable, especially for younger investors. AI is also being used in other areas of banking, such as risk management and customer service.Biometric Authentication and Security Biometric authentication systems, such as facial recognition and fingerprint scanning, are being used to improve security in banking. These systems provide a more secure and convenient way to authenticate transactions and access bank accounts.

Conclusion The future of banking is being shaped by fintech. From mobile banking apps to digital payment systems, cryptocurrencies, and AI-powered robo-advisors, fintech is revolutionizing the way we manage our finances. As fintech continues to evolve, we can expect to see even more innovative solutions that make banking more convenient, accessible, and secure.

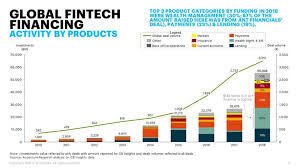

Statistics: - The global fintech market is projected to reach $305 billion by 2025. (Source: ResearchAndMarkets) - Mobile banking apps have been adopted by 60% of smartphone users worldwide. (Source: Deloitte) - Digital payments are expected to reach $14.34 trillion in transaction value by 2023. (Source: Statista)

Sources: - "The Future of Banking" by Deloitte - "Fintech Market Size, Share & Trends Analysis Report" by ResearchAndMarkets - "Digital Payments Market" by Statista